Don’t File Your Taxes Until You Read This Crucial Regime Comparison! New Tax Slab Before you file your taxes, read our in-depth comparison of the new tax slab regime. Uncover hidden benefits and potential pitfalls to maximise your returns.

Ever sat down to file your taxes and thought, “Am I actually choosing the right regime?” You’re not alone. With 84% of taxpayers reportedly losing money by picking the wrong option, this isn’t just a small financial hiccup – it’s potentially lakhs of rupees walking out your door.

I’ve spent weeks analyzing both tax regimes so you don’t have to waste your weekend with spreadsheets and calculators.

The latest income tax regime comparison reveals something shocking: if you’re earning up to 12 lakh annually, one option clearly puts more money in your pocket. But it’s not as straightforward as the headlines claim.

Don’t File Your Taxes Until You Read Before you click “submit” on your tax filing this year, there’s a critical calculation most tax advisors aren’t telling you about – and it could be the difference between a refund and regret.

Don’t File Your Taxes Until You Read And Understanding India’s Tax Regimes for 2025-26

Old vs. New Tax Regimes: Key Differences Explained

Look, taxes in India just got a whole lot more complicated. The old regime gives you tons of deductions but higher base rates, while the new one strips away those sweet exemptions but offers lower rates overall. Your choice basically boils down to this: do you have big investments and loans to write off? Stick with old. Living paycheck to paycheck? The new regime might put more cash in your pocket. Don’t File Your Taxes Until You Read carefully

Tax Brackets and Slabs: Complete Breakdown

| Income Range | Old Regime Rate | New Regime Rate |

|---|---|---|

| Up to ₹3 lakh | Exempt | Exempt |

| ₹3-6 lakh | 5% | 5% |

| ₹6-9 lakh | 20% | 10% |

| ₹9-12 lakh | 20% | 15% |

| ₹12-15 lakh | 30% | 20% |

| Above ₹15 lakh | 30% | 30% |

The table doesn’t lie – middle-income folks see the biggest difference. That 10-15% gap between ₹6-12 lakh? Game-changer for many.

Who Benefits Most from Each Regime?

Old regime winners? Homeowners with big loans, parents paying tuition, and investment junkies maxing out their 80C deductions. The new regime shines for gig workers, young professionals just starting out, and anyone who hates keeping receipts. Your life stage matters more than your income bracket when picking sides.

Recent Updates to the Tax Structure

The 2025 budget threw us some curveballs – standard deduction under the new regime jumped to ₹75,000, and they finally increased the NPS contribution limit to 15%. Plus, that new tax rebate for incomes up to ₹7.5 lakh? Total game-changer for millions of taxpayers. Don’t sleep on these changes or you’ll literally leave money on the table.

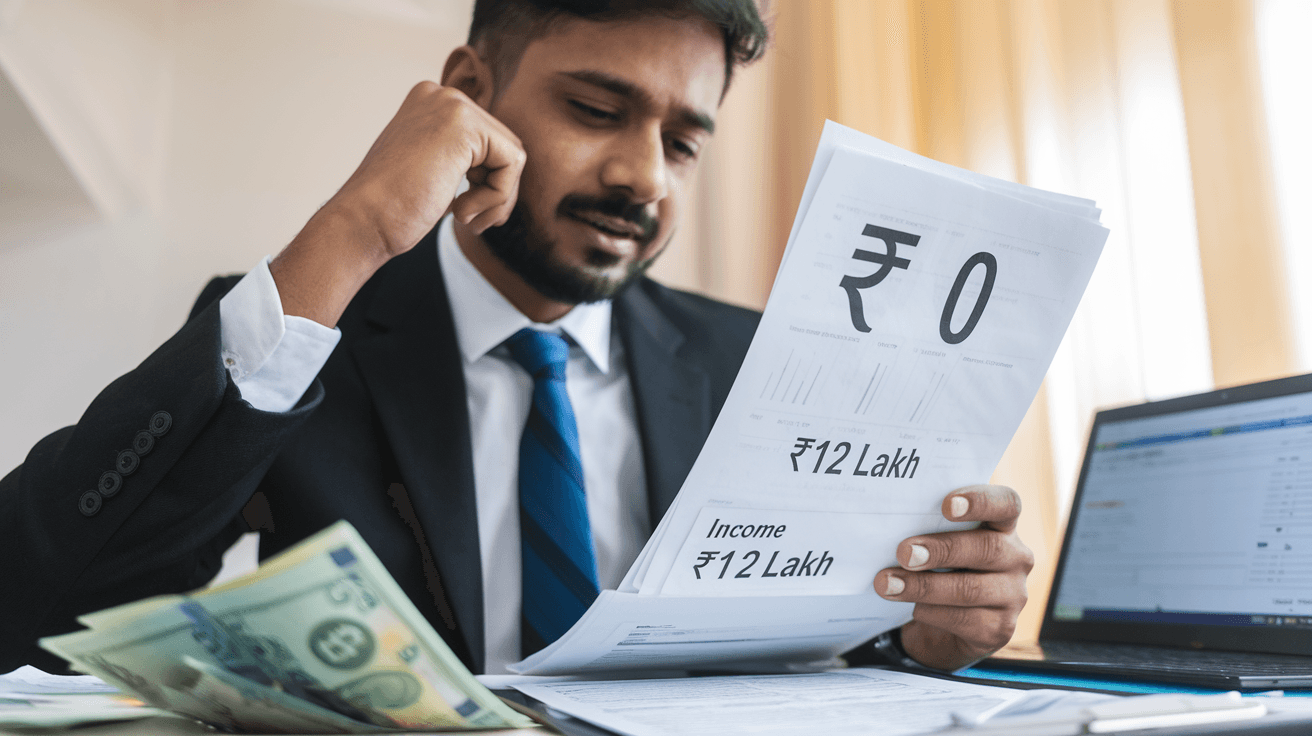

The Zero Tax Strategy for Income up to ₹12 Lakh

How the New Regime Makes This Possible

Think you can’t escape taxes on income up to ₹12 lakh? Think again! The new tax regime’s standard deduction of ₹75,000 combined with strategic investments in NPS and health insurance creates a sweet spot. By maximizing these specific deductions while following the new regime’s simplified structure, you’re looking at potentially zero tax liability.

Deductions and Exemptions to Maximize

The secret sauce to zero tax? Stack these deductions strategically and Don’t File Your Taxes Until You Read this

- ₹75,000 standard deduction (automatic)

- Up to ₹1.5 lakh in Section 80C investments

- Additional ₹50,000 in NPS under 80CCD(1B)

- ₹25,000-₹50,000 for health insurance premiums

- Housing loan interest up to ₹2 lakh

- ₹25,000 for education loan interest

Don’t just pick random deductions – build a targeted strategy based on your income structure.

Step-by-Step Tax Planning Approach

- Calculate your gross income from all sources

- Subtract the standard deduction of ₹75,000

- Map out available deductions you can realistically claim

- Prioritize high-return investments that also offer tax benefits

- Adjust monthly investments to meet deduction thresholds

- Document everything meticulously for filing

- Review quarterly to stay on target

Start this process in April, not March. Playing catch-up rarely works.

Case Studies: Real-World Examples

Case #1: Salaried Professional (₹10.5 Lakh)

Rohan, 32, software developer:

- Gross salary: ₹10,50,000

- Standard deduction: ₹75,000

- NPS contribution: ₹50,000

- 80C investments: ₹1,50,000

- Health insurance: ₹25,000

- Home loan interest: ₹2,00,000

Result: Zero tax liability

Case #2: Self-Employed Consultant (₹12 Lakh)

Priya, 45, marketing consultant:

- Gross income: ₹12,00,000

- Professional expenses deduction: ₹3,00,000

- Remaining strategic deductions: ₹3,00,000

Result: Zero tax liability

Common Mistakes to Avoid

Don’t sabotage your zero-tax strategy! The biggest blunders include missing documentation deadlines, overlooking reconciliation of Form 26AS with your investments, and the classic last-minute rush leading to suboptimal choices. Another fatal error? Assuming all deductions apply equally to both regimes. They don’t. Don’t File Your Taxes Until You Read

The smartest taxpayers plan in Q1 rather than scrambling in Q4 when options become limited and expensive.

Optimizing Your Tax Savings in Both Regimes

Optimizing Your Tax Savings in Both Regimes

A. Investment Options That Reduce Tax Liability

Ever wonder why some folks pay way less tax than you? They’re not cheating—they’re strategizing. Smart investments like ELSS funds, PPF accounts, and NPS contributions can slash your tax bill in both regimes. The old regime gives you more deduction options, but even under the new regime, certain investments still make financial sense beyond just tax benefits.

B. Section 80C Deductions Worth Considering -Don’t File Your Taxes Until You Read

The 80C section is your tax-saving superhero, offering up to ₹1.5 lakh in deductions. Life insurance premiums, home loan principal repayments, children’s tuition fees, and EPF contributions all count here. But don’t just invest to save tax—pick options that also align with your financial goals. Remember, these deductions only apply in the old tax regime.

C. Housing Loan Benefits and Tax Implications

Your home loan isn’t just giving you a place to live—it’s a tax-saving machine. Interest payments up to ₹2 lakh are deductible under Section 24(b) in the old regime. First-time homebuyers get an additional ₹50,000 deduction under Section 80EE. The new regime sacrifices these benefits for lower tax rates, so crunch those numbers carefully.

D. Health Insurance and Medical Expense Deductions

Health insurance premiums aren’t just protecting your health—they’re protecting your wealth too. Section 80D allows deductions up to ₹25,000 for your policy (₹50,000 for senior citizens). Additional deductions for preventive health check-ups and specific medical treatments can add up quickly. These benefits vanish in the new regime, so factor that into your decision.

Strategic Decision-Making for Your Tax Filing Don’t File Your Taxes Until You Read

Strategic Decision-Making for Your Tax Filing

A. Self-Assessment Tools to Choose the Right Regime

Still scratching your head about which tax regime to pick? Stop guessing and start calculating. The Income Tax Department’s official calculator lets you compare both regimes side-by-side with your actual numbers. Quick tip: don’t just look at this year’s savings—think about your 5-year financial roadmap before deciding.Don’t File Your Taxes Until You Read

B. Salary Structure Optimization Tips

Your salary structure can make or break your tax bill. Restructure it to maximize tax-free allowances like HRA if you’re renting. If your employer offers NPS contributions, that’s an additional 10% deduction goldmine. And don’t overlook meal vouchers—small benefits add up to serious savings when you’re pushing that ₹12 lakh threshold.Don’t File Your Taxes Until You Read

C. Business Income vs. Salary Income Considerations

Business owners face a different tax reality than salaried folks. Under the old regime, entrepreneurs can claim actual expenses—everything from office rent to travel costs. Meanwhile, the new regime’s flat rates might benefit salaried individuals with fewer deductions. The tipping point? Usually around ₹8 lakh where the math starts favoring one side.

D. Special Scenarios for Seniors and Super Seniors

If you’re 60+, the tax game has different rules. Seniors enjoy higher basic exemption limits—₹3 lakh instead of ₹2.5 lakh. Super seniors (80+) get an even sweeter deal with ₹5 lakh exempt. Medical insurance premiums offer additional deductions up to ₹50,000. Plus, seniors can claim deductions on medical treatments without the usual thresholds.

Expert Tax Planning Beyond Basic Compliance

Expert Tax Planning Beyond Basic Compliance

A. Advanced Tax-Saving Instruments

Looking beyond the obvious Section 80C investments? Smart move. National Pension System offers additional tax benefits up to ₹50,000 under Section 80CCD(1B). Infrastructure bonds, sovereign gold bonds, and tax-free bonds provide excellent tax-efficient returns while diversifying your portfolio. These instruments fly under most taxpayers’ radar but can significantly reduce your tax burden.

B. Long-Term Wealth Building with Tax Efficiency

Tax efficiency isn’t just about saving money today—it’s about building wealth tomorrow. Equity-linked savings schemes (ELSS) offer the dual benefit of wealth creation and tax deduction with the shortest lock-in period of just 3 years. Strategic investments in ULIPs held for over 10 years enjoy tax exemption on gains. Systematic investment in asset classes with favorable tax treatment compounds your wealth exponentially over decades.

C. Family Tax Planning Strategies

The family that plans taxes together stays wealthy together! Income splitting between family members can substantially reduce your collective tax burden. Gift money to your spouse for investments, create Hindu Undivided Family accounts, or set up trusts for minors. Consider joint property ownership with parents or spouse to distribute rental income. Even paying salaries to family members in your business creates legitimate tax advantages.

D. Documentation and Proof Requirements

The taxman cometh—and he wants receipts. Maintain impeccable documentation for every deduction claimed. Digital receipts for Section 80G donations, Form 16 from employers, 80D health insurance premium receipts, and home loan interest certificates are non-negotiable. Keep investment proofs organized by section number in digital and physical formats. Remember, undocumented deductions are practically invitations for tax notices.

E file ITR details step by step

E-Filing Made Simple: Your Ultimate Guide to Filing Income Tax Returns Online

Ready to tackle your taxes this year? E-filing your income tax return is now easier than ever. Just log in to the Income Tax Portal using your PAN, select the right assessment year (AY 2025-26 for FY 2024-25), choose your ITR form based on your income sources, verify your pre-filled details, and submit. Remember to e-verify within 30 days or your return won’t count!

Navigating India’s tax landscape for 2025-26 requires careful consideration of both regimes to maximize your savings, especially with the opportunity to pay zero tax on income up to ₹12 lakh through strategic planning. By understanding the nuances of deductions, exemptions, and investment options available under each regime, you can make informed decisions that align with your financial goals and potentially save significant amounts in taxes.

Don’t File Your Taxes Until You Read this Before rushing to e-file your return, take time to compare both tax regimes using the strategies outlined in this guide. Remember that effective tax planning goes beyond basic compliance—it’s about making your money work smarter for you year-round. Whether you choose the new regime for simplicity or the old regime for maximizing deductions, the right choice depends on your unique financial situation. Consult with a tax professional if needed, and make this tax season your most financially advantageous one yet.